Article by – Srinidhi Boray

The Adam Smith’s Theory needs Sledge Hammer treatment

Econophysics – Interdisciplinary Approach to Study Behavioral Economics

All system display behavior those are dynamic in nature. The study of the system dynamics finds many of the classical models inadequate. In the world of physics, Newtonian classical models progressed into Einstein relativity and then into quantum dynamics. While the subject progressed, the inadequacies in the discipline surfaced and newer and newer mechanisms were sought to represent and study the subject more accurately. Many challenges remain in studying the system as a whole by reconciling macroscopic aspects that with the microscopic behaviors. To further the cause in the realm of physics, ‘Unified Theory’ is being attempted that brings together the different aspects of the macro and the micro. One of the stark features of any system is that it is deterministic in a probabilistic way, but remains in-deterministic when processes around individual events are followed. Also, the physical nature at the macrocosm completely alters when studied at the microscopic level. At one level it is a particle and in another it is quanta (or a wave). The probabilistic studies are attempted by applying Monte Carlo computational approach, which iteratively incorporates various coefficients in its attempts to discover the probable behavior. The random occurrences are studied applying stochastic methods.

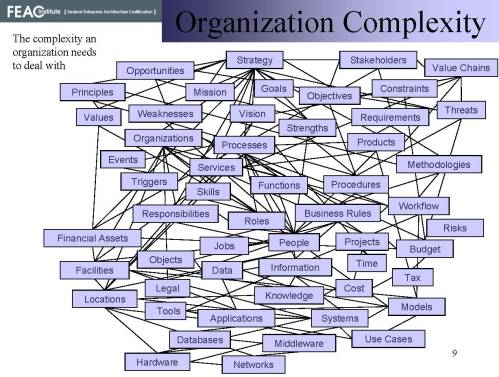

Lot of similarities are being discovered between the systems dynamic studies that applied in Physics and Economics. Especially when the equilibrium studies are conducted in a system characterized by heterogeneous agents. It is argued by many that the neoclassical economics relies on principles that worked well in a system based on the Adam Smith’s simple axioms in which the heterogeneous agent complexities do not exist. Adam Smith’s principle sates that the individual greed plays a vital part on the overall economics for the better good of the whole society and then invisible hand works to correct the course when in-equilibrium occurs. This notion is now being contested to be an incorrect assumption. For, in modern economics era, the unpredictability of the market is in the lack of understanding the complex agent behaviors, that exists more like a flux, which is difficult to be discerned. This adds to the conundrum when predicting the random events in a market that is inherently unstable. Furthermore, the flux state defies the Cartesian system, based on which the present computations are derived. Almost all the applied agent behavior incorporates coefficients that encapsulate the supply demand behavior triggered by the one or more variables as observed within the Cartesian coordinate system.

In the recent times, few universities have begun to conduct formal research in the econophysics area. One of the goals is to rewrite the economics theory by reconsidering the dynamics that relies on the realities of the unstable behavior.

Reference:

http://www.phys.uh.edu/research/econophysics/

http://en.wikipedia.org/wiki/Econophysics

http://www.unifr.ch/econophysics/articoli/papers/Economic_System_Dyn-joco.pdf

http://www.unifr.ch/econophysics/comments/nov_99/9911291.pdf

Click to access PhysicaA-299-213-2001.pdf

http://www.pbs.org/wgbh/commandingheights/

Recent Article on Economic Disparities owing to Gaussian Distribution

Concentration of wealth in hands of rich greatest on record

Share on Facebook

BY DANIEL TENCER

Published: August 15, 2009

Updated 1 day ago

“The world is in trouble,” Walter told CNBC.

Published on Friday, August 21, 2009 by Facing South